Purchase Money Security Interest Ucc | Under the ucc, a security interest generally does not attach unless three basic requirements are met. A lender finances a debtor's purchase of an expensive piece of equipment and takes a security interest in the equipment to secure the purchase money loan. Part of the arrangement requires the seller to contact any other lenders with security claims on the distributor's operations. A pmsi is an interest in goods securing an obligation for payment for the price of the goods. What does this legal jargon mean in english on a credit app?

What does this legal jargon mean in english on a credit app? Special rules apply to purchase money security interests in inventory. However, the secured party must comply with the ucc perfection and notice requirements to obtain pmsi priority. Purchase money security interests (pmsis) can allow a lender to jump ahead of a vendor's otherwise first priority lien rights. Ucc pmsis are available for.

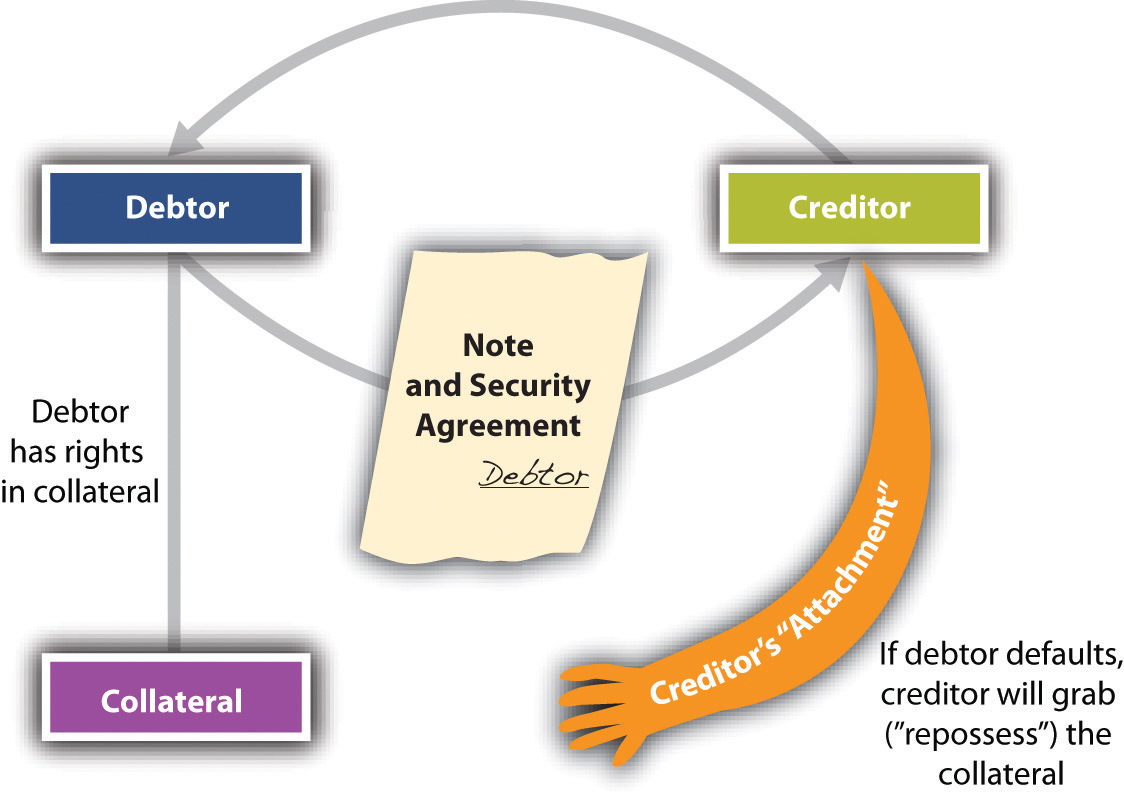

In simplest form, the requirements are that: A purchase money security interest is a legal first claim to repossess property financed with its loan when a borrower defaults. Purchase money security interests (pmsis) can allow a lender to jump ahead of a vendor's otherwise first priority lien rights. A pmsi is an interest in goods securing an obligation for payment for the price of the goods. Purchase money security interests the uniform commercial code governs pmsis. Wwi recommended procedure for finalizing a purchase money security interest (pmsi) our recommended procedure is as follows: (i) the seller finances the purchase or (ii) the creditor gives value so that the. The ucc gives special benefits to a purchase money security interest which, generally speaking, is a security interest in goods or certain software (called purchase money collateral) that secures an obligation of an obligor (1) incurred as all or part of the price of the collateral or (2). Collection of most popular forms in a given sphere. A lender finances a debtor's purchase of an expensive piece of equipment and takes a security interest in the equipment to secure the purchase money loan. A lender that advances money used by a buyer to make a purchase or a seller that e … A security interest that is created when a buyer uses the lenders money to make the purchase and immediately gives the lender security (see the uniform commercial code); The purchase money security interest (pmsi) provides substantial benefits for both lenders and borrowers.

The most likely candidates are Collection of most popular forms in a given sphere. A purchase money security interest is a legal first claim to repossess property financed with its loan when a borrower defaults. The ucc gives special benefits to a purchase money security interest which, generally speaking, is a security interest in goods or certain software (called purchase money collateral) that secures an obligation of an obligor (1) incurred as all or part of the price of the collateral or (2). Arises when the secured party advances money or credit to enable the debtor to purchase the collateral.

The ucc gives special benefits to a purchase money security interest which, generally speaking, is a security interest in goods or certain software (called purchase money collateral) that secures an obligation of an obligor (1) incurred as all or part of the price of the collateral or (2). The uniform commercial code (the ucc) provides certain creditor protections that can dramatically change a vendor's chances at full recovery. Under the ucc, you can obtain a security interest in almost any type of personal property. In simplest form, the requirements are that: Special rules apply to purchase money security interests in inventory. The most likely candidates are However, the secured party must comply with the ucc perfection and notice requirements to obtain pmsi priority. In the context of an advance, it secures the obligation to repay the advance. Purchase money security interests the uniform commercial code governs pmsis. A purchase money security interest is a legal first claim to repossess property financed with its loan when a borrower defaults. Part of the arrangement requires the seller to contact any other lenders with security claims on the distributor's operations. Ucc pmsis are available for. A pmsi is an interest in goods securing an obligation for payment for the price of the goods.

The purchase money security interest (pmsi) provides substantial benefits for both lenders and borrowers. (19.) and the under the ucc, a security interest generally does not attach unless three basic requirements are met. A lender that advances money used by a buyer to make a purchase or a seller that e … A security interest that is created when a buyer uses the lenders money to make the purchase and immediately gives the lender security (see the uniform commercial code); Arises when the secured party advances money or credit to enable the debtor to purchase the collateral.

The priority in cash is limited, however, if the cash is deposited in a deposit account. What does this legal jargon mean in english on a credit app? A security interest is a legal right granted by a debtor to a creditor over the debtor's property (usually referred to as the collateral) which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations. The ucc gives special benefits to a purchase money security interest which, generally speaking, is a security interest in goods or certain software (called purchase money collateral) that secures an obligation of an obligor (1) incurred as all or part of the price of the collateral or (2). A purchase money security interest is a legal first claim to repossess property financed with its loan when a borrower defaults. Part of the arrangement requires the seller to contact any other lenders with security claims on the distributor's operations. A security interest that is created when a buyer uses the lenders money to make the purchase and immediately gives the lender security (see the uniform commercial code); In order to qualify for pmsi priority in inventory the ucc extends pmsi priority to identifiable proceeds from the sale of the collateral. A lender that advances money used by a buyer to make a purchase or a seller that e … Purchase money security interests the uniform commercial code governs pmsis. The fundamentals of ucc pmsis. The uniform commercial code (the ucc) provides certain creditor protections that can dramatically change a vendor's chances at full recovery. The purchase money security interest (pmsi) provides substantial benefits for both lenders and borrowers.

Purchase Money Security Interest Ucc: Under the ucc, a security interest generally does not attach unless three basic requirements are met.